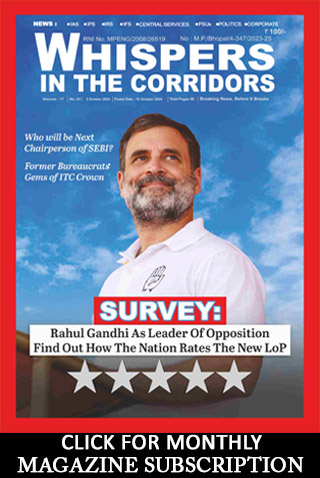

whispers in the corridors

Housing and Urban Development Corporation Ltd. (HUDCO) has reported a robust performance in the First Half of the Fiscal Year 2025 (H1FY25), showcasing record-breaking growth across key financial parameters. Key highlights from HUDCO’s H1FY25 results include : Loan Sanctions: HUDCO achieved the highest-ever H1 loan sanctions, reaching ₹76,472 crore, marking an astounding Year-over-Year (YoY) growth of almost 10x compared to H1FY24 (₹7,808 Crore). Loan Disbursements: With the highest-ever H1 Loan Disbursements of ₹21,699 Crore, HUDCO recorded an impressive almost 6x YoY growth from ₹3,723 Crore in H1FY24. Profit After Tax (PAT): The company reported a PAT of ₹1,246.37 Crore in H1FY25, a39% increase from ₹897.39 Crore in H1FY24, marking its highest-ever H1 profit. Revenue from Operations: HUDCO recorded its highest-ever H1 Revenue from Operations at ₹4,706.07 Crore in H1FY25, a 27% YoY increase from ₹3,706.41 Crore in H1FY24. Loan Book: The Loan Book stood at ₹1,11,068 Crore increased by 36% compared to ₹81,594 Crore in H1FY24. Net Worth: HUDCO’s Net Worth saw a 9% growth, increasing to ₹17,124.35 Crore in H1FY25 from ₹15,724.40 Crore in the same period last year. Earnings Per Share (EPS): EPS increased by 39% YoY, reaching ₹6.23 from ₹4.48 in H1FY24. Market Capitalization: HUDCO’s market cap surged over 2.53 times within a year to ₹43741.52 Crore in H1FY25, reflecting investor confidence in the company’s growth trajectory. Asset Quality: HUDCO reported a significant improvement in asset quality, with Gross NPAs reduced to 2.04% from 3.36% YoY and Net NPAs to 0.31% from 0.49% YoY, positioning HUDCO as an industry leader in asset management. Profitability Ratios: Return on Equity (RoE) improved significantly to 14.56% from 11.41% YoY, while Return on Assets (RoA) saw a positive trend, increasing to 2.40% in H1FY25 from 2.20%. HUDCO’s sustained focus on strategic initiatives, efficient loan management, and improved asset quality has contributed to this strong financial performance, further solidifying its position in the industry.

Send Feedback

- Pramod Kumar Khatri appointed CVO, CLW

- Pramod B Gadre appointed Dean, IRIEEN

- Rajiv Kumar Barnwal appointed CESE, SCR

- Manoj Kumar Jindal appointed CESE, NFR

- Manoj Goyal is CAO, Dahod, Western Railway

- JCS Bora appointed PCSO, NCR

- Anil Kumar Jain appointed PCSO, SWR

- Deen Bandhu Singh appointed PCEE (C), North Central Railway

- Singh is GM (S&T), DFCCIL

- 13 IAS officers shifted in Telangana

- Karthikeyan assigned addl charge of Regional Deputy Director, WCCB, Chennai

- Central deputation tenure of Siddharth Mahajan extended

- Ms Rashi Sharma empanelled as Joint Secretary in GoI

- Anil Chandra Punetha appointed as Vigilance Commissioner, AP

- CM Secretariat in J&K gets two officers

- IoFS officer transferred to J&K

- Two vacancies of Member in CBDT

- H Lalengmawia gets additional charge of Chief Secretary, Mizoram

- Keshav Chandra appointed Chairperson, NDMC

- Dr V Candavelou appointed CS, Goa